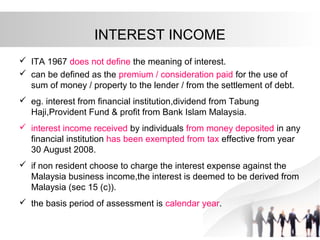

So why would your bank pay you a rental fee. On 16 May 2016 the Inland Revenue Board of Malaysia published Public Ruling No.

Personal Income Tax Interest Income Tax Treatment

As part of a Tax Saving Fixed Deposit interest earned is taxable which is deducted at source.

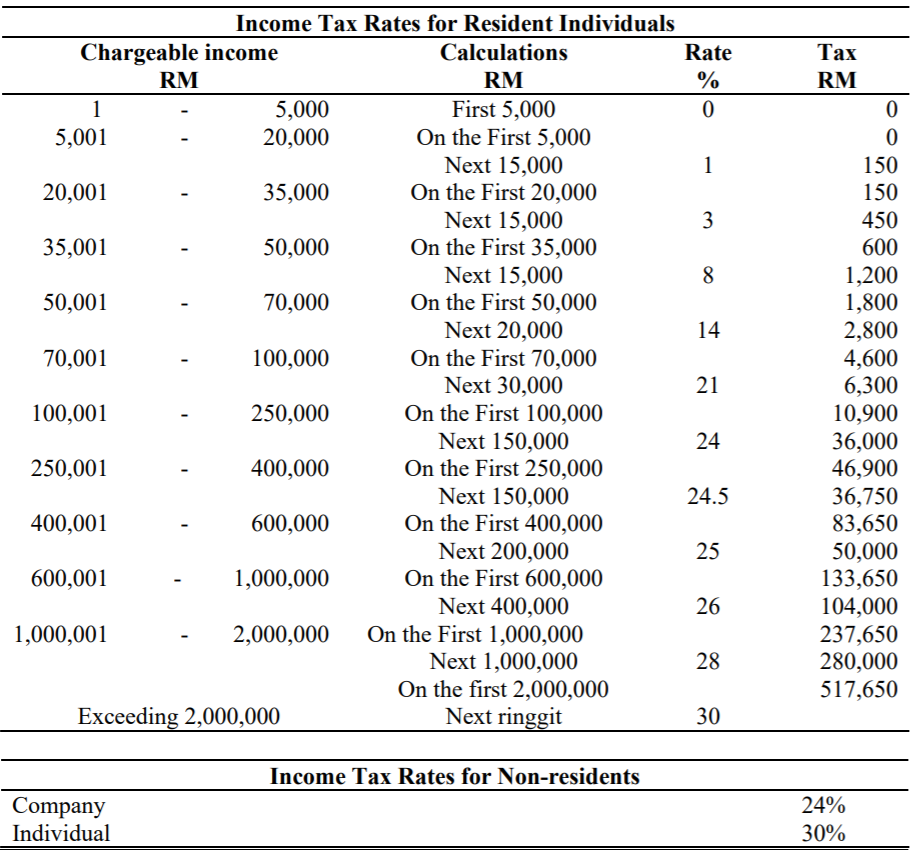

. Interest on fixed deposit account of up to a maximum of. The tables below will be updated every month. Dividends received from exempt accounts of companies.

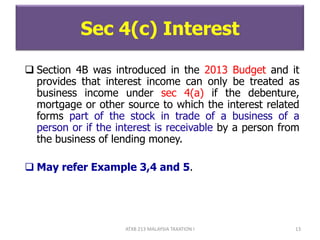

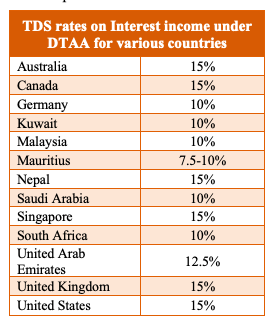

However the company can claim interest expense against its investment income since the investments are deemed to have been financed by the overdraft. 32016 on the tax treatment of interest income received by a person carrying on a business including a company a body of persons a limited liability partnership and a corporation sole. The bank will make a TDS deduction on the interest from all the fixed deposits you have with the bank.

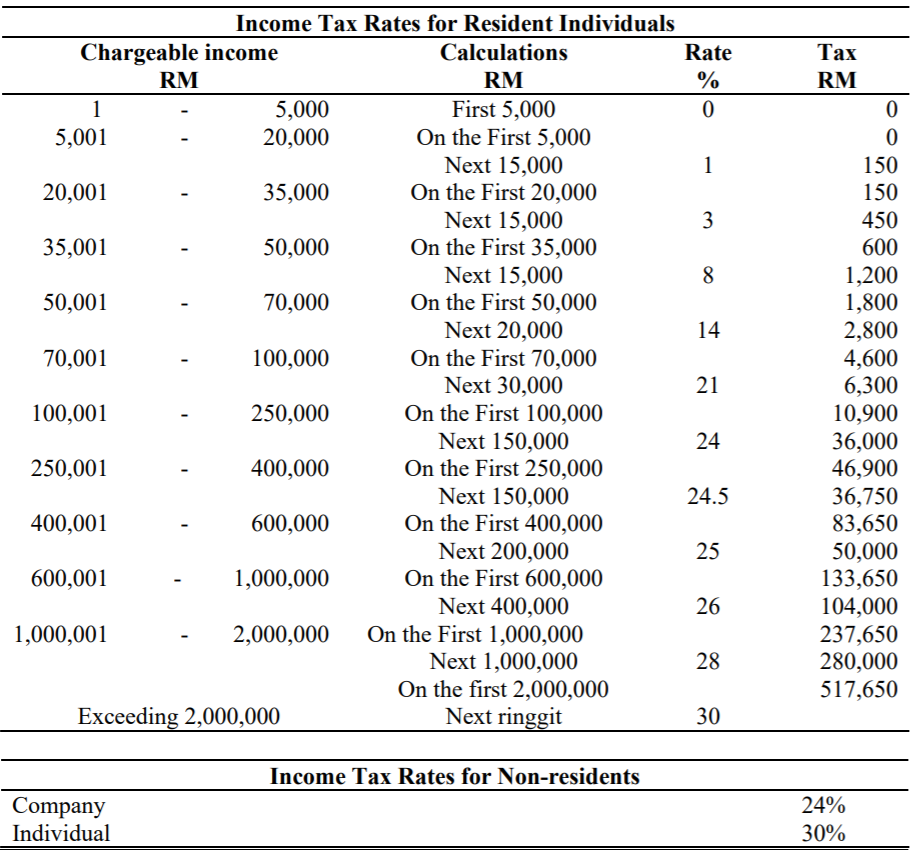

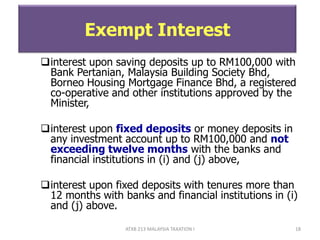

Dividends received from a unit trust approved by the Minister of Finance such as Amanah Saham Bumiputra. Interest income Interest received by individuals on money deposited in approved institutions which include all licensed banks and financial institutions is tax exempt. However if you do not provide your PAN details to the bank it will deduct 20 TDS from interest.

And Debt securities eg. To calculate income tax on interest on fixed deposit. The current interest rate ranges from 55 to 67 depending on tenure.

Things like parking and childcare allowances which fall under Perquisites above can also be exempted from tax. Top 1-month FD rates in. Tax benefits are sometimes used to encourage certain government objectives.

If youve deposited as 5-year term deposits the depositor can receive up to 150000 rupees tax-free as per section 80C under the Income Tax Act 1961. Interest received by individuals on money deposited in approved institutions which include all licensed banks and financial institutions is tax exempt. For example the interest you earn off a fixed deposit or certain dividend payments are fully exempted from income tax.

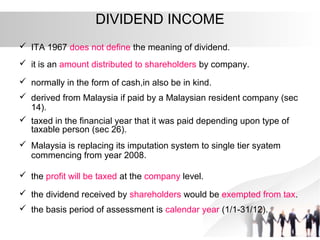

Bonds that are i owned by a partnership or ii inventory of a trading business. Park your cash in the FD account and you get back your initial deposit principal along with interest of 365 per annum pa or an Effective Interest RateEIR of 182 after 6 months. Dividends received from cooperative societies.

Under Section 61A 1 of the Income Tax Act these two types of companies do not pay tax as long as they pay out 90 of their profits for the year as dividends to their shareholders - and those shareholders in turn dont have to declare this income for tax purposes. Reporting interest You must declare the full amount of your taxable interest. Companies are not required to deduct tax from dividends paid to shareholders and no tax credits will be available for offset against the recipients tax liability.

40000 then there will be a TDS deduction at a 10 rate. RM30000 has to be added back in the companys tax computation which means only RM10000 is deductible as a business expense. It may range between 1 to 5 years.

So when identifying which fixed deposit account to put your money in the main points of consideration should be interest rates minimum deposit amount and if they are insured by PIDM. An investor can claim income tax exemption on investments up to Rs 15 lakh when investing in Fixed Deposits. If your interest income from all those FDs goes beyond Rs.

In the case of Mochiko Co. The Tax Policy Department of the IRBM has clarified that Section 140B of the MITA is applicable to directors of the company as defined in Section 75A 2 of the MITA and to loans or advances which are financed by the companys internal funds only. The following dividends are exempt form tax.

If you deposit 100000 in your savings account for 12 months the bank will in return pay a rental fee interest rate usually between 05-2 to you for borrowing your money. Youll then have earned between RM 500 RM 2000 in 12 months. There are no premature withdrawals loans or overdraft OD facilities for tax-saving FDs.

Here are the highest interest fixed deposit accounts in Malaysia arranged by duration. Post office FDs are higher than those in the market. Best Fixed Deposit Accounts In Malaysia - July 2022.

Interest from the refund of excess employees CPF contributions. It does not apply to loansadvances funded from external loans or loans from third parties. Currently it is Rs.

When the income from the interest of a fixed deposit exceeds Rs 40000 the bank or financial institutions deducts tax at source in the form of tax from the depositor. The computation of interest expense for each investment source is. Regular Fixed Deposits provide a loan facility.

Taxation Principles Dividend Interest Rental Royalty And Other So

In The Matter Of Interest Crowe Malaysia Plt

Taxation Principles Dividend Interest Rental Royalty And Other So

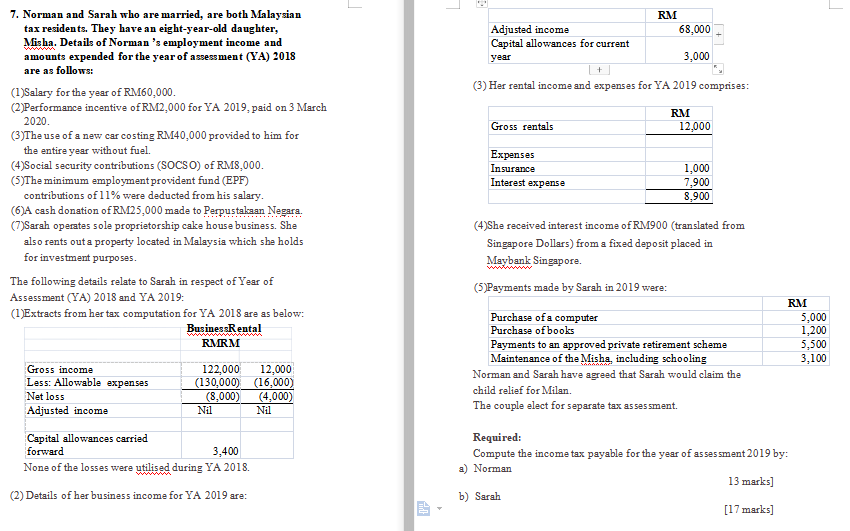

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

Chapter 5 Non Business Income Students

Income Tax Testbankanssss Pdf Tax Deduction Taxpayer

Solved Please Note That This Is Based On Philippine Tax System Please Put Course Hero

Solved Please Note That This Is Based On Philippine Tax System Please Put Course Hero

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

Taxation Principles Dividend Interest Rental Royalty And Other So

Section 80tta Tax Benefits Nri Can Claim 10 000 Inr On Interest Of Saving Account

Analyzing A Bank S Financial Statements

The Following Allowances And Tax Rates Are To Be Used Chegg Com

How Much Tds Is Deducted On Bank Company And Nro Fixed Deposits Nri Banking And Saving Tips Savings And Investment Investment Tips Investing

Does It Make Sense For Nris To Invest In Bank Fixed Deposits Scripbox

Chapter 5 Non Business Income Students

Taxation Principles Dividend Interest Rental Royalty And Other So

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)